Valuable Opportunities Offered Through the International Association of Black Actuaries

We invited Kate Weaver, Executive Director of the International Association of Black Actuaries (IABA) to share information about IABA and the opportunities available to students through this organization. To learn about the benefits of student membership, and access information about the IABA scholarship, networking opportunities, and Job Board, read on.

What is IABA?

IABA is a volunteer-run, nonprofit organization that represents black actuarial professionals and students around the world.

The organization consists of a group of leaders and volunteers that work together to accomplish our mission through the support of strategic plan initiatives and IABA programming. Our mission is to contribute to an increase in the number of black actuaries and to influence the successful career development, civic growth and achievement of black actuaries.

Student Membership

Membership is open to all who support our mission. Annual membership dues for college students are $15.

College Student Membership Benefits include:

- Access to IABA job board for internships and entry-level positions, as well as opportunities to participate in resume books

- Access to introductory actuarial webinars

- Special student tier sessions at Annual Meeting

- Access to IABA Foundation Scholarship application

- IABA Foundation Actuarial Boot Camp opportunities

- Access to actuarial mentors/role models by phone or email

- Networking through local and national events, including participation at the Career Networking Event at the Annual Meeting

- Experience the camaraderie and fun that results from being involved with IABA!

Scholarship

The IABA Foundation Scholarship Program provides scholarships at the undergraduate and graduate level for black students who are interested in pursuing actuarial careers.

IABA has awarded over $400,000 in scholarships since 1992. Scholarships are awarded on basis of merit and can be renewed.

In 2014, IABA awarded over $70,000 in scholarships to 22 graduating high school seniors, undergraduate and graduate students. Five scholarships included internships or entry-level offers. Scholarships also include IABA annual meeting attendance (including travel), membership dues, and assignment of IABA mentor. This year, all eligible applicants will be entered into a drawing for $1,000!

The application deadline for the 2015 Scholarship Program is May 1, 2015. Download this flyer to learn more about application requirements and where to apply.

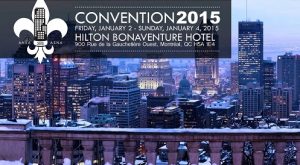

Annual Meeting

From professional development to networking opportunities, the IABA Annual Meeting can help you take your actuarial career to the next level.

- Career Networking Event: An exciting opportunity to interact with industry professionals in a casual & intimate atmosphere.

- IABA Networking Reception: Experience the host city while engaging with old and new friends.

- Professional Development: With sessions tiered to experience level, attendees will learn something new, and can earn at least 10 continuing education credits.

- Annual Awards Banquet: A time to recognize new designees, exam passers, and those who helped IABA throughout the year.

Special student rate is $125 for members, $150 for non-members.

Boot Camp

The IABA Foundation Actuarial Boot Camp is geared towards increasing industry awareness of prospective actuarial students and positioning them for a successful actuarial internship.

The 4-day program covers a variety of professional development and business skill topics and also provides the following to prospective actuarial students: exposure to real world actuarial work, resources in preparing for professional exams, the soft skills needed to successfully interview for and land an internship, as well as extended support to remain on your chosen career pathway as you return to your respective academic programs. The Actuarial Boot Camp is typically held in conjunction with the IABA Annual Meeting and includes attendance to the Annual Meeting.

Students can apply for the program through the IABA website and will be selected to attend free of charge, less a registration fee. The Boot Camp concludes with participation, paid registration and accommodation at the IABA Annual Meeting.

Learn what happened at the 2014 Boot Camp on the IABA website. Additional information about the 2015 program and application materials will be announced on the website in coming months.

Job Board

Dozens of actuarial employers use the IABA job board on a regular basis to post jobs and search career profiles. Job posters are often specifically seeking diverse candidates. That makes our job board a strong channel for the best jobs/internships and a great way to get your resume in front of your next employer. There is no cost to participate.

As the future of the property and casualty insurance industry, we know that you are interested in topics related to emerging risks. Take a moment to read this blog post, shared earlier this month with CAS members, and familiarize yourself with the exciting changes and risks that are facing the insurance industry. Knowledge of these emerging risks – many of which will be addressed while you are in the early stages of your actuarial career – will be valuable as you take part in networking events and interviews with industry professionals.

As the future of the property and casualty insurance industry, we know that you are interested in topics related to emerging risks. Take a moment to read this blog post, shared earlier this month with CAS members, and familiarize yourself with the exciting changes and risks that are facing the insurance industry. Knowledge of these emerging risks – many of which will be addressed while you are in the early stages of your actuarial career – will be valuable as you take part in networking events and interviews with industry professionals.

In any profession, staying current with industry news is critical for career success. Members of CAS Student Central have also recognized this need and inquired about which industry media sources are most valuable to follow. In my role as marketing and communications manager at the CAS, I actively seek ways to partner with insurance industry publications. These same publications can be a useful tool for students to keep informed about the insurance industry. Subscribing to daily news updates, for example, can help you to identify topics that interest you professionally, remain current with industry trends, and even gain a leg up as you apply for internships and jobs.

In any profession, staying current with industry news is critical for career success. Members of CAS Student Central have also recognized this need and inquired about which industry media sources are most valuable to follow. In my role as marketing and communications manager at the CAS, I actively seek ways to partner with insurance industry publications. These same publications can be a useful tool for students to keep informed about the insurance industry. Subscribing to daily news updates, for example, can help you to identify topics that interest you professionally, remain current with industry trends, and even gain a leg up as you apply for internships and jobs.

4. Your study approach from university can serve as a foundation, but it may need an overhaul…

4. Your study approach from university can serve as a foundation, but it may need an overhaul…

The CAS, which recently celebrated its centennial anniversary, has always been committed to producing property and casualty actuaries of the highest caliber. As the actuarial profession continues to evolve, so does the educational training that actuaries need in order to stay ahead of the curve. For example, over the past decade, it has become increasingly important for property and casualty actuaries to have a deeper understanding of statistics and its applications. At the same time, the CAS recognizes that the statistical foundation to perform advanced analytics is currently missing from the Syllabus of Basic Education. To fill this gap, the CAS will roll out a comprehensive preliminary exam and introduce advanced statistical topics within current examinations.

The CAS, which recently celebrated its centennial anniversary, has always been committed to producing property and casualty actuaries of the highest caliber. As the actuarial profession continues to evolve, so does the educational training that actuaries need in order to stay ahead of the curve. For example, over the past decade, it has become increasingly important for property and casualty actuaries to have a deeper understanding of statistics and its applications. At the same time, the CAS recognizes that the statistical foundation to perform advanced analytics is currently missing from the Syllabus of Basic Education. To fill this gap, the CAS will roll out a comprehensive preliminary exam and introduce advanced statistical topics within current examinations.

Significant tuition assistance, an all-expenses paid trip to the CAS Annual Meeting, networking opportunities with the leaders in the casualty actuarial profession, and access to world-class professional development sessions; these are some of the countless benefits I have received since being selected as one of the 2014 CAS Trust Scholarship recipients.

Significant tuition assistance, an all-expenses paid trip to the CAS Annual Meeting, networking opportunities with the leaders in the casualty actuarial profession, and access to world-class professional development sessions; these are some of the countless benefits I have received since being selected as one of the 2014 CAS Trust Scholarship recipients.

Internships. Hiring teams often prefer or even require actuarial internship experience. If you can, get one or two actuarial internships while in school. Any familiarity with actuarial work is going to help you get interviews, and additionally, may be a path to a full-time role or a recommendation. Also, internships provide a great opportunity to test the waters in P&C, Health, Life, and Pension to gain a better idea of where you may ultimately see yourself. It is common to assume that internships are only offered to current students. However, there are also companies who are open to taking on college graduates in their internship programs, so it is always worthwhile to keep an eye open for these opportunities if you are still looking to break into the field.

Internships. Hiring teams often prefer or even require actuarial internship experience. If you can, get one or two actuarial internships while in school. Any familiarity with actuarial work is going to help you get interviews, and additionally, may be a path to a full-time role or a recommendation. Also, internships provide a great opportunity to test the waters in P&C, Health, Life, and Pension to gain a better idea of where you may ultimately see yourself. It is common to assume that internships are only offered to current students. However, there are also companies who are open to taking on college graduates in their internship programs, so it is always worthwhile to keep an eye open for these opportunities if you are still looking to break into the field. Interviews.

Interviews.

ADAM NOREEN, Recruiter, adam.noreen@dwsimpson.com

ADAM NOREEN, Recruiter, adam.noreen@dwsimpson.com

The actuarial community, while expanding remarkably, remains a tight-knit network. It is vital that aspiring actuaries actively participate in events which encourage interaction amongst students and professionals, to plant and nurture the seeds that will develop into fruitful future professional relationships – and student conventions are a great place to start!

The actuarial community, while expanding remarkably, remains a tight-knit network. It is vital that aspiring actuaries actively participate in events which encourage interaction amongst students and professionals, to plant and nurture the seeds that will develop into fruitful future professional relationships – and student conventions are a great place to start!

Internship Opportunities

Internship Opportunities Where We Work

Where We Work