Preparing to be an Actuary at a School Without an Actuarial Science Program

One of the strengths of the actuarial profession is its willingness – indeed, its desire – to welcome and accommodate people with very different backgrounds. In our roles as identifiers, quantifiers, and managers of risk, actuaries benefit society by utilizing the variety of perspectives and approaches to risk that diversity provides.

One of the strengths of the actuarial profession is its willingness – indeed, its desire – to welcome and accommodate people with very different backgrounds. In our roles as identifiers, quantifiers, and managers of risk, actuaries benefit society by utilizing the variety of perspectives and approaches to risk that diversity provides.

One aspect of diversity and strength within the actuarial profession involves schools and majors. The CAS recognizes that good students and future actuaries can and will emerge from colleges with small, or even no, actuarial science program, and that students with non-actuarial majors can provide unique and important perspectives and skills. To be sure, there are certain realities about the actuarial profession – one must have at least a minimal level of quantitative skill, and be able to pass actuarial exams. Beyond that, though, there are a variety of skills and perspectives that are valuable in an actuarial career.

Below is a list of some courses that a student at basically any university should consider taking in preparation for a career as an actuary:

- Probability and Statistics: Most schools have at least one or two courses in probability and statistics. This material is foundational for the quantitative skills required by actuaries. A full year of probability and statistics – i.e., a two-semester-course sequence – would be ideal. It would also be ideal if these courses had a full sequence of calculus as their prerequisite. But if your school offers something different in this area, take whatever is available.

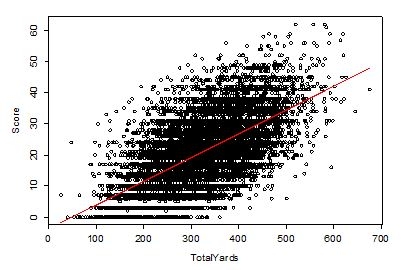

- Other Math: Good math is always worth studying – not necessarily because of the material itself, but because it helps to build a systematic and logical way of thinking. Certainly, you should take the full sequence of calculus courses offered, but additional courses beyond calculus and probability-statistics are often worthwhile. Courses involving linear algebra, regression analysis, or advanced statistics are particularly worth considering, but courses like advanced calculus or analysis can also sharpen your quantitative skills.

- Economics: Developing an understanding of economic issues and processes is one of the best things you can do for yourself – whether you end up being an actuary, or most anything else. Take (at least) a basic microeconomics and a basic macroeconomic course. In addition to learning the classroom material, regularly read the economics section of a newspaper, and try to develop an intuitive “feel” for economics. There are also many excellent general-readership books available that can help you better appreciate the economic forces affecting individuals, countries, and the world.

- Finance: Try to take at least one finance course, covering the basics of corporate finance, investments, and/or derivatives. A course that covers some financial math (e.g., interest theory, bond and loan mathematics) is particularly valuable.

- Computer Science: Learn some programming – and it doesn’t matter too much what language or software you study, because the foundational skills are largely transferable to others. Beyond basics like Word and Excel, items worth being exposed to include any of Visual Basic, C++, R, and SAS.

- Communications: The best actuaries are the ones who combine excellent technical abilities with the “softer” skills. Try to take courses that expose you to, and enhance your skills in, both verbal and written communications.

- Science: Actuaries often model natural phenomena and their impact on humans. Science courses can help you to appreciate the underlying principals and forces that result in risks.

- Other: Strive to be a student of the world. Our world and civilization are a complex network of interconnected and interdependent forces and activities. Understanding how it all fits together, and where the risks and potential for breakdowns are, represents the value of the actuarial function. Almost any subject, and any academic department, will have courses that are relevant to this broad perspective.

Many of the courses and skills mentioned above are expanded upon in the CAS Curriculum Guide, available to download in the online community. The Guide will help you identify experiences to seek out while in college to prepare for a future career as an actuary.

Actuarial science is one of the most multi-disciplinary of professions. Whether your major is math, economics, or business – or philosophy, history, or science – you will encounter skills and a way of thinking that are useful to a potential career in actuarial science. And whatever college or university you call home, you can make your dreams of becoming an actuary come true!

Rick Gorvett, FCAS, is Director of the Actuarial Science Program and is the State Farm Companies Foundation Scholar in Actuarial Science at University of Illinois-Urbana Champaign, where he has taught for 14 years. He also serves on the CAS Board of Directors and the CAS University Engagement Committee.

A recording of the

A recording of the  After the webinar, use the

After the webinar, use the

As the future of the property and casualty insurance industry, we know that you are interested in topics related to emerging risks. Take a moment to read this blog post, shared earlier this month with CAS members, and familiarize yourself with the exciting changes and risks that are facing the insurance industry. Knowledge of these emerging risks – many of which will be addressed while you are in the early stages of your actuarial career – will be valuable as you take part in networking events and interviews with industry professionals.

As the future of the property and casualty insurance industry, we know that you are interested in topics related to emerging risks. Take a moment to read this blog post, shared earlier this month with CAS members, and familiarize yourself with the exciting changes and risks that are facing the insurance industry. Knowledge of these emerging risks – many of which will be addressed while you are in the early stages of your actuarial career – will be valuable as you take part in networking events and interviews with industry professionals.

In any profession, staying current with industry news is critical for career success. Members of CAS Student Central have also recognized this need and inquired about which industry media sources are most valuable to follow. In my role as marketing and communications manager at the CAS, I actively seek ways to partner with insurance industry publications. These same publications can be a useful tool for students to keep informed about the insurance industry. Subscribing to daily news updates, for example, can help you to identify topics that interest you professionally, remain current with industry trends, and even gain a leg up as you apply for internships and jobs.

In any profession, staying current with industry news is critical for career success. Members of CAS Student Central have also recognized this need and inquired about which industry media sources are most valuable to follow. In my role as marketing and communications manager at the CAS, I actively seek ways to partner with insurance industry publications. These same publications can be a useful tool for students to keep informed about the insurance industry. Subscribing to daily news updates, for example, can help you to identify topics that interest you professionally, remain current with industry trends, and even gain a leg up as you apply for internships and jobs.

4. Your study approach from university can serve as a foundation, but it may need an overhaul…

4. Your study approach from university can serve as a foundation, but it may need an overhaul…

The CAS, which recently celebrated its centennial anniversary, has always been committed to producing property and casualty actuaries of the highest caliber. As the actuarial profession continues to evolve, so does the educational training that actuaries need in order to stay ahead of the curve. For example, over the past decade, it has become increasingly important for property and casualty actuaries to have a deeper understanding of statistics and its applications. At the same time, the CAS recognizes that the statistical foundation to perform advanced analytics is currently missing from the Syllabus of Basic Education. To fill this gap, the CAS will roll out a comprehensive preliminary exam and introduce advanced statistical topics within current examinations.

The CAS, which recently celebrated its centennial anniversary, has always been committed to producing property and casualty actuaries of the highest caliber. As the actuarial profession continues to evolve, so does the educational training that actuaries need in order to stay ahead of the curve. For example, over the past decade, it has become increasingly important for property and casualty actuaries to have a deeper understanding of statistics and its applications. At the same time, the CAS recognizes that the statistical foundation to perform advanced analytics is currently missing from the Syllabus of Basic Education. To fill this gap, the CAS will roll out a comprehensive preliminary exam and introduce advanced statistical topics within current examinations.

Significant tuition assistance, an all-expenses paid trip to the CAS Annual Meeting, networking opportunities with the leaders in the casualty actuarial profession, and access to world-class professional development sessions; these are some of the countless benefits I have received since being selected as one of the 2014 CAS Trust Scholarship recipients.

Significant tuition assistance, an all-expenses paid trip to the CAS Annual Meeting, networking opportunities with the leaders in the casualty actuarial profession, and access to world-class professional development sessions; these are some of the countless benefits I have received since being selected as one of the 2014 CAS Trust Scholarship recipients.